12 per cent would build an extension to watch TV in a separate room to their partner

42 per cent of Brits say extending their home provides better value for money than moving

April is the most popular month to start an extension build

MoneySuperMarket research published today reveals that a proportion of Brits, over one in 10, would build an extension specifically to watch TV in a separate room away from those they live with.

A new study by the UK’s leading price comparison website looked into the motivations behind home extensions and why they are often preferred over moving.

Current financial pressures have shown that 42 per cent of Brits would rather extend than move, as it is simply better value for money. Just 24 per cent of Brits said moving was a better financial decision. The recent increase in the Bank of England base rate from 0.5 per cent to 0.75 per cent will lead to more expensive mortgages for many, making it even more likely that homeowners will prefer to improve their current residence rather than relocate.

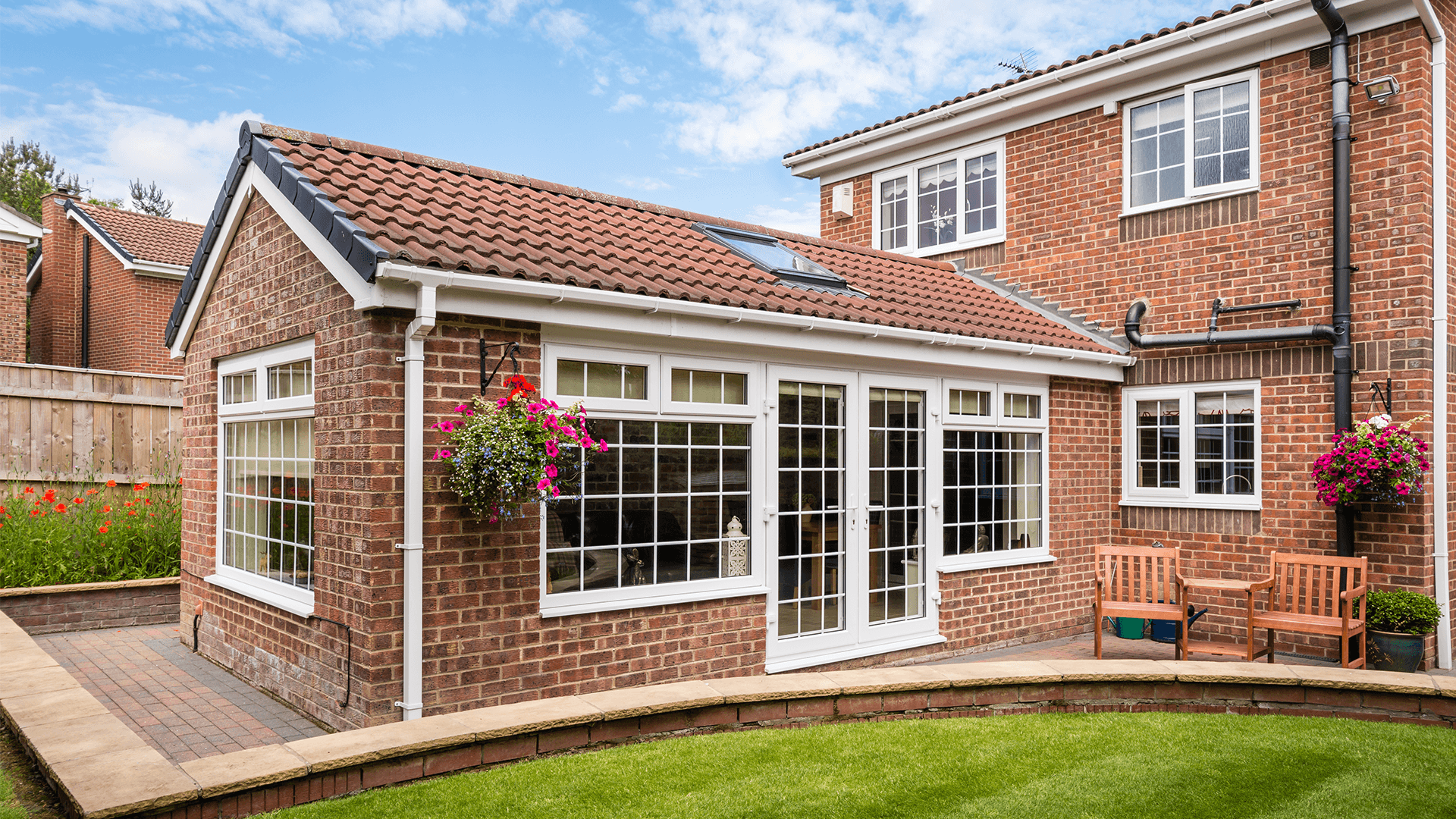

Those looking to create more space prefer to opt for simple builds such as single-storey or rear extensions (48 per cent), followed by double or multi-storey extensions (34 per cent) and conservatories (29 per cent). Conversions are also popular options, with loft conversions coming out top at 28 per cent, followed by garage conversions (26 per cent) and basement conversions (13 per cent).

The research shows that Brits decide to extend for many reasons:

· Home office or business space – 31 per cent

· Creative space (e.g. music, art or writing) – 27 per cent

· Dinner parties and entertaining – 24 per cent

· Fitness, gym or yoga space – 22 per cent

· Annex for elderly relatives – 17 per cent

· Walk-in wardrobe – 15 per cent

· Lease the extra space for additional income – 13 per cent

· Separate room to watch TV away from their partner – 12 per cent

The biggest barrier to moving according to homeowners is the lack of suitable properties on the market (39 per cent), which is then followed, perhaps unsurprisingly, by the unaffordability of housing (38 per cent). However, higher than expected property prices are not isolated to London, as nearly half (45 per cent) of Yorkshire respondents also felt this way, followed by 44 per cent of South West homeowners.

Moving home is likely to be a bigger financial commitment than extending your current property, so it makes sense that nearly three in 10 (28 per cent) worry about the risk of interest rate rises and are hesitant to set up a new mortgage as a result.

For the two-fifths of Brits who believe extending is the better financial decision, it was found that the most popular month to start the building work is April:

· 1st – April (20 per cent)

· 2nd – May (16 per cent)

· 3rd – March (11 per cent)

· 4th – September (10 per cent)

· 5th – June (10 per cent)

A MoneySuperMarket spokesperson commented: “Choosing whether to stick or twist when you outgrow your property is a major life-stage decision, particularly if you want to work from home or provide accommodation for elderly relatives. What’s crucial is that people weigh up their options to ensure they get the best value for the money they spend.

“Those having work done to their home certainly have to consider the impact on their home insurance. You need to tell your insurer as soon as work begins, so they can determine whether the project will affect your premiums – if they think there’s an increased risk of damage from the building work or a danger that burglars might exploit the situation, your premiums would increase. If you increase your square footage, that will also bump up what you pay.

“If you have a new space in the home, you’re likely to put possessions in it, which could change the amount of contents cover you need. And if you start working from home, you’ll need extra protection from your home insurance.

“If you fail to tell your insurer you’re having work done and detail the changes that it will bring, either because you don’t think it necessary or you don’t want to pay more for cover, you risk not having a claim paid if something goes wrong. So, it’s always better to keep your insurer up to speed with what you’re doing.”

Visit MoneySuperMarket’s “Extend or Move” page to find out the best choices when it comes to extending or moving home for homeowners.