The Board of Springfield Properties (AIM: SPR), a leading housebuilder in Scotland delivering private and affordable housing, is pleased to announce that it has completed the acquisition of the issued share capital of DHomes 2014 Holdings Limited (trading as Dawn Homes), a Glasgow-based housebuilder focussed on private housing in West Central Scotland and Ayrshire, for a consideration of up to £20.1 million (‘Acquisition’).

The Company also announces that it has conditionally raised gross proceeds of £15 million through the placing of 12,500,000 new ordinary shares (‘Placing Shares’) with new and existing investors at 120 pence per Placing Share (‘Placing Price’). The net proceeds will be used to partially re-finance the initial cash consideration paid in respect of the Acquisition.

Acquisition Highlights

Under the terms of the Acquisition, the Company will pay an initial consideration of £17.6 million, of which:

– £15.5 million will be settled in cash and initially financed by available headroom within the Company’s existing revolving credit facility

– £2.1 million to be satisfied by the issue of 1,750,000 new ordinary shares (the ‘Consideration Shares’)

An additional £2.5 million may be payable in cash, contingent on the Company receiving zoning on Dawn Homes’ site at Johnstone, near Glasgow, and is expected to be financed from available free cash flow at that time

Net debt of approximately £6.7 million was assumed by the Company following completion of the Acquisition

The Directors believe the Acquisition will:

– Accelerate the Company’s growth

– Be significantly earnings enhancing in its first full year

– Expand the Company’s private land bank in West Central Scotland and Ayrshire in line with stated strategy to expand into new regions

– Provide an established supply chain in Glasgow with access to local labour and subcontractors

Placing Highlights

Placing of 12,500,000 Placing Shares with new and existing investors at 120 pence per Placing Share

The net proceeds will be used to partially re-finance the initial cash consideration paid in respect of the Acquisition

The Placing Price represents a discount of approximately 3.2 per cent. to the closing price on 1 May 2018, being the last practicable trading day prior to the release of this announcement

The Placing is conditional, inter alia, upon the approval of the Placing by Shareholders at a general meeting of the Company which is expected to be convened for 1:00 pm on 21 May 2018 (the ‘General Meeting’)

Sandy Adam, Executive Chairman of the Company, commented on the Acquisition of Dawn Homes:

‘This was a rare opportunity to acquire a profitable company that builds great homes. Dawn Homes is a well-run business with an excellent reputation in Western Central Scotland. I am delighted that they are joining our team and welcome all their employees into our company. There is a massive need for more housing in Scotland and Springfield will play a significant part in addressing that need. We will be supporting the skilled Dawn Homes team to build more homes each year. Overall, this acquisition will enable Springfield to grow and deliver housing more widely across Scotland.’

Innes Smith, CEO of the Company, added:

‘We are delighted to have successfully completed this placing and for the strong support received from new and existing investors. The acquisition is part of our stated strategy of accelerating growth through expansion into new areas. Through the purchase of Dawn Homes, we have gained another foothold in another part of Scotland. The focus of both companies continues to be looking after our customers, building great homes and building more homes. We look forward to updating the market on our progress.’

Application has been made for the Consideration Shares to be admitted to AIM and admission is expected to take place on 3 May 2018 at 8:00 am.

Immediately following Admission of the Consideration Shares, the Company’s issued share capital will consist of 83,833,642 ordinary shares with voting rights. This figure may be used by Shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, the share capital of the Company under the FCA’s Disclosure Guidance and Transparency Rules.

The Circular, extracts of which are set out below, is expected to be posted in the coming days, and will provide details of, and the background to, the Acquisition and the Placing, and sets out the reasons why the Board believes that the Placing is in the best interests of the Company and its Shareholders and to seek Shareholder approval of the Resolutions at the forthcoming General Meeting.

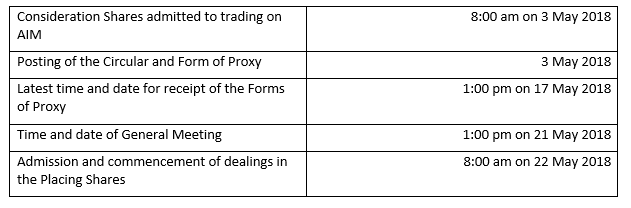

Expected timetable

Each of the times and dates above refer to London time and are subject to change by the Company. Any such change will be notified to shareholders by an announcement on a Regulatory Information Service. The Circular will contain further details of the expected timetable for the Placing and the General Meeting.

Enquiries

Springfield Properties

Sandy Adam, Executive Chairman and Innes Smith, Chief Executive Officer

Tel: +44 1343 552550

N+1 Singer

Shaun Dobson, James White

Tel: +44 20 7496 3000

Luther Pendragon

Harry Chathli, Claire Norbury, Alexis Gore

Tel: +44 20 7618 9100

Terms used but not defined in this announcement shall have the meanings given to such terms in the circular.