Ever looked at the price of a new build home and wondered how developers arrive at that final figure? It’s a common question, and the answer is far more complex than just the cost of bricks and mortar.

For many, the most tangible part of a new home is the physical structure itself. However, the actual construction cost is just one piece of a much larger puzzle. To understand the true cost of a new home, we need to look beyond the building site and consider the entire development process from the initial price of the land the home is built on, right up to the developer’s profit margin, revealing the hidden costs that contribute to the final price tag when a developer brings a new home to the market.

Let’s delve into the intricate cost breakdown, to find out the real cost of a new build home in the UK.

The anatomy of a new build: More than just construction

Recent data from The Housing Forum provides a detailed breakdown of the costs associated with building a standard three-bedroom semi-detached house in the UK. While the core construction cost is significant, it’s the additional expenses that often surprise homebuyers. These include everything from preparing the site and connecting utilities to marketing the property and covering financing costs.

The cost breakdown for a new build house

| Cost Component | Estimated Cost | Percentage of Total Build Cost |

| Core Construction | £133,000 | 52.8% |

| * Substructure (foundations) | £18,000 | 7.1% |

| * Superstructure (house shell) | £67,000 | 26.6% |

| * Finishes (plaster, paint) | £18,000 | 7.1% |

| * Fittings (kitchen, bathroom) | £8,000 | 3.2% |

| * Preliminaries & Management | £22,000 | 8.7% |

| External Works & Utilities | £42,000 | 16.7% |

| Abnormal Costs | £40,000 | 15.9% |

| Finance, Fees & Marketing | £26,000 | 10.3% |

| Planning & Future Homes Standard | £10,700 | 4.3% |

| Total Build Cost (excl. Land & Profit) | £251,700 | 100% |

Source: The Housing Forum

One of the most significant variables in this breakdown is “abnormal costs.” This is a catch-all term for a wide range of expenses that can arise depending on the specific site. These can include remediating contaminated land, dealing with archaeological finds, or making significant upgrades to local infrastructure. These costs can vary dramatically from one development to another, adding a layer of financial risk for the developer.

The land game: A third of the price?

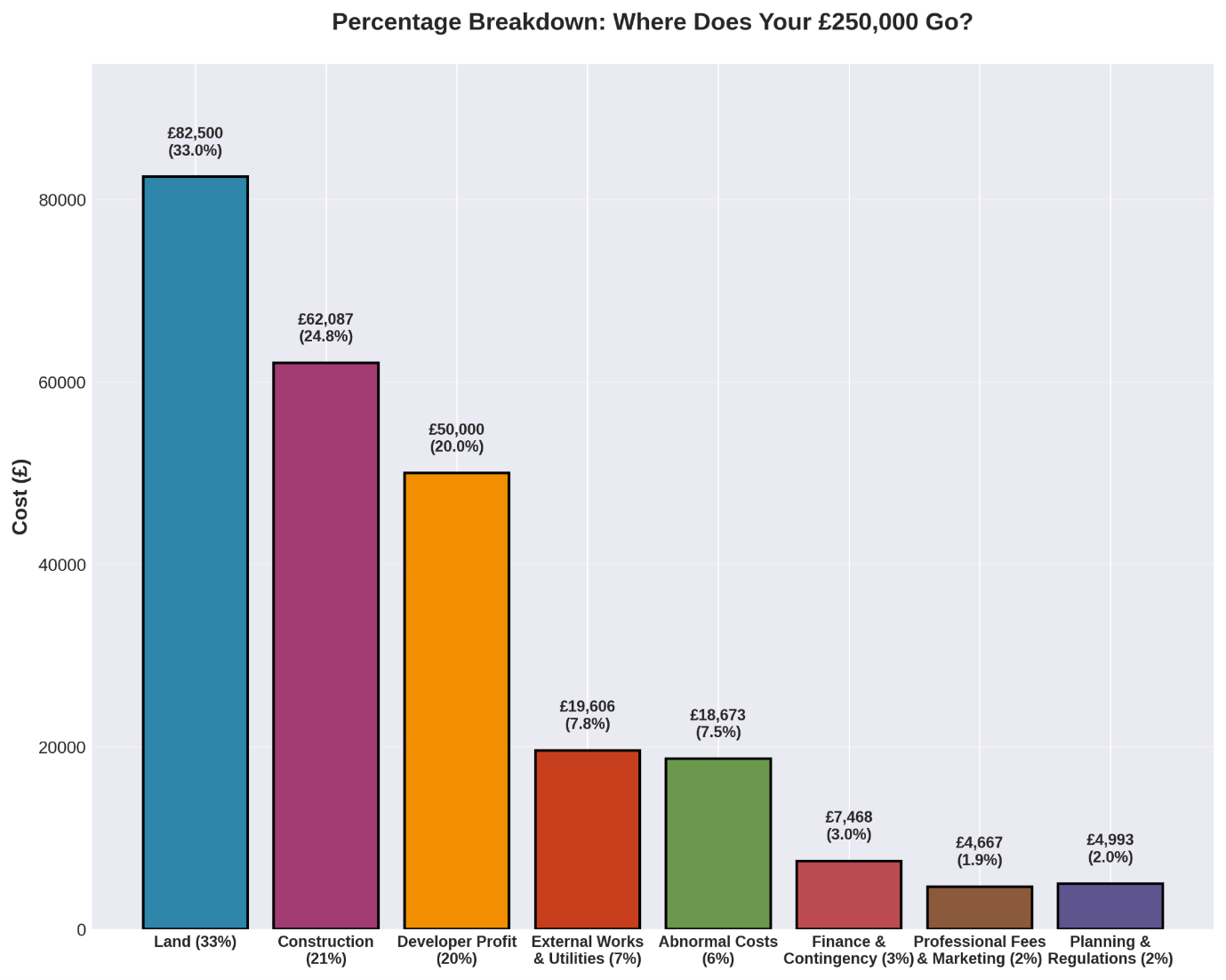

The cost of land is a huge factor in the final price of a new home. A long-standing rule of thumb in the development industry is that land accounts for approximately one-third of the Gross Development Value (GDV) of a project. This means that for a typical £250,000 home, around £82,500 of the price is attributable to the land it’s built on.

Developers typically use a “residual land valuation” method to determine how much they can afford to pay for a plot of land. This involves estimating the final sales value of the homes they plan to build and then subtracting all the other costs, including construction, fees, and their desired profit margin. What’s left is the maximum price they can pay for the land.

The developer’s margin: Profit and risk

Of course, developers are not building homes for free. A significant portion of the final price is the developer’s profit margin. Research from Brunel University indicates that for larger new build developments from the industry’s biggest hitters, a target profit margin of 20-30% is not uncommon. For our £250,000 example, a 20% profit margin would equate to £50,000.

While this may seem like a large sum, it’s important to remember that this margin also needs to cover the significant risks involved in property development. These can include unexpected construction problems, delays in the planning process, and fluctuations in the housing market.

The final tally: Visualising the total cost

Taking all these costs into account, the chart below provides a visual representation of how developers reach the £250,000 price tag for a new home.

As this breakdown clearly shows, the journey from a plot of land to a finished home involves a multitude of different costs, each contributing to the final price paid by the buyer. While the cost of construction is a major component, it’s the combination of land costs, developer profit, and other project specific expenses that truly shapes the price of a new build home in the UK.

So, the next time you see the valuation of a new build home, you’ll have a much clearer understanding of the complex network of costs that have gone into creating it. From the land it’s built on to the developer’s profit margin, every pound of the purchase price has a purpose. While the exact breakdown will vary from one development to another, the fundamental principles remain the same: building a new home can be an expensive and complex undertaking, and the final price reflects that reality.