Palm Beach County New Construction: HOA vs CDD Costs, Incentives & Buyer Tips

New homes promise modern design, energy savings, and hurricane-ready construction—but they also bring unique costs and decisions.

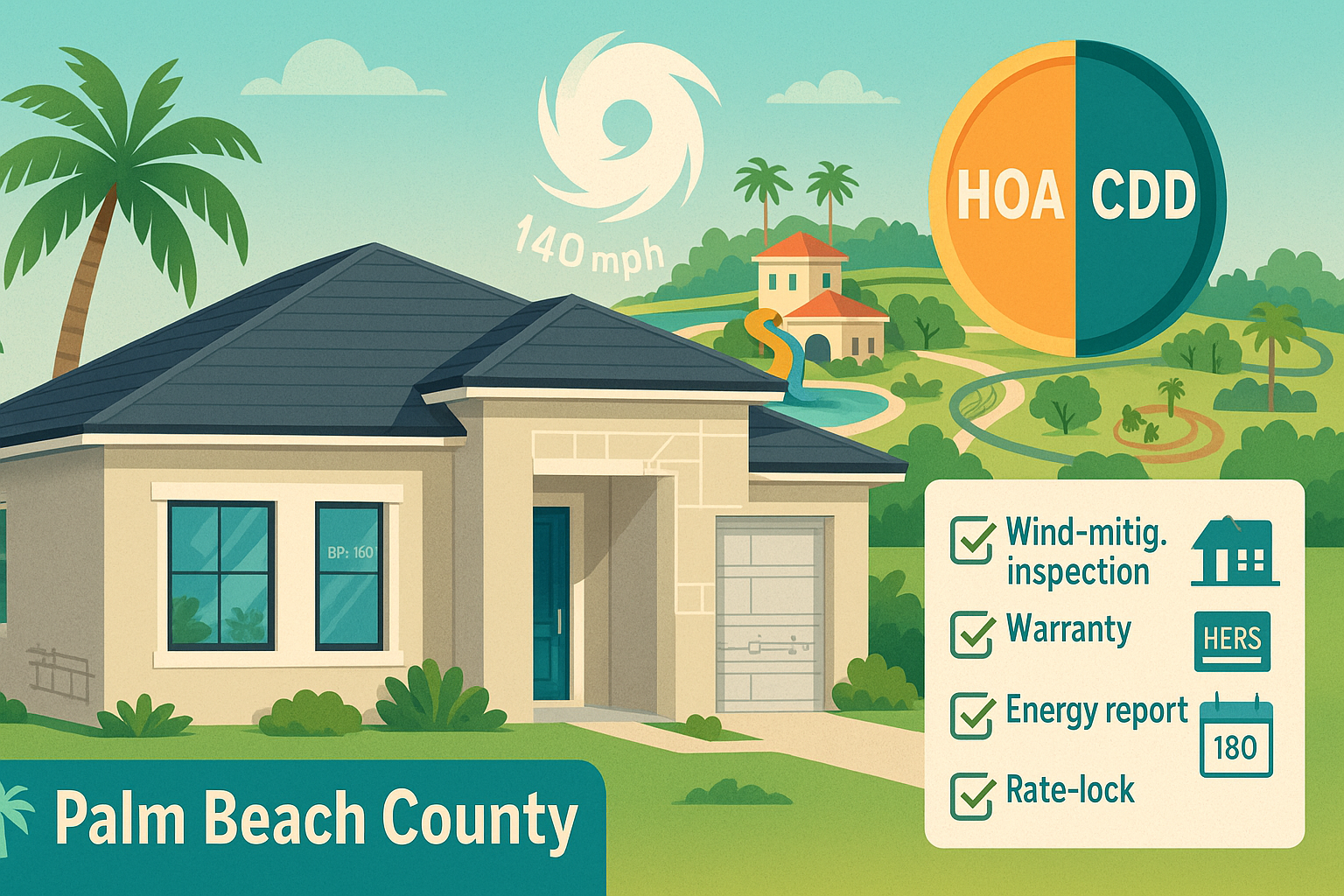

Built For Florida Storms

Homes permitted after Dec 31, 2023, must meet the 8th-Edition Florida Building Code. All of Palm Beach County is in a wind-borne debris region with ultimate design wind speeds ≥140 mph, so builders use impact windows or shutters, strapped roof-to-wall connections, and reinforced garage doors—systems designed to stay intact in a Category 3 hurricane. Those features can cut the wind portion of your homeowners’ premium by roughly 20–30% on brand-new construction. Before closing, book a wind-mitigation inspection so your insurer applies every available credit.

Warranty Peace Of Mind

Large Florida builders typically include a 1-2-10 warranty, which covers 1 year of workmanship, 2 years of major systems (electrical, plumbing, and HVAC), and 10 years of third-party structural coverage. If the AC fails in month eight or a truss issue appears years later, eligible repairs are covered per the policy. Warranties usually transfer to the next owner, adding resale appeal—keep your documents handy.

Energy Efficiency & Lower Bills

Florida’s updated Energy Conservation Code (effective Dec 31, 2023) tightened targets for insulation (e.g., R-38 attics), window performance (U-factor ≤0.40, SHGC ≤0.25), and HVAC efficiency (e.g., minimum SEER2 15.2 heat pumps in this climate zone). Paired with LED lighting and smart thermostats, these measures can trim cooling demand ~30% versus older code-minimum homes—often $600+ in annual savings at current rates. Ask for the REScheck or HERS report showing projected kWh usage and file it for resale; documented efficiency helps justify value.

Amenities & community perks

Palm Beach County’s master-planned communities feel like private resorts. Westlake’s 15-acre Adventure Park offers a lagoon pool, tower slide, BMX pump track, dog park, and event lodge. Typical HOAs of ~$300–$450/month cover pools, fitness, and events that cost more à la carte.

Trade-offs: phased construction traffic, ongoing building, and crowded amenities. Weigh a five-minute waterslide weekend against short-term noise and dust.

To compare amenities and HOA details, speak with a local Palm Beach County real estate team like SquareFoot Homes to assist in exploring new-construction listings and communities.

Lot Premiums Add Up

Builders price the house and homesite separately. Interior lots may carry no premium, but corner, cul-de-sac, and water-view sites commonly add 5–15% to the base price; waterfront can reach ~10% or more. On a $700,000 build, that’s roughly $35,000–$105,000—usually non-refundable and often financed into your mortgage (meaning you’ll pay interest, too). Verify the exact premium in writing before you fall for the model-home view.

Upgrade Costs Can Balloon

Design-center choices are the easiest budget buster. Buyers at production builders commonly spend ~5–12% of base price on options; luxury finishes can push 10–25%. On a $650,000 build, that’s about $32,500–$162,500 rolled into the loan. Tour the model with the “included features” list in hand and decide room-by-room what you’ll use every day (worth doing now) versus what can be DIY’d or hired out later for less.

Smart Buyer Moves

- Lock wind-mit credits with a pre-close inspection.

- Keep all warranty and efficiency documentation.

- Validate HOA dues, amenity access rules, and construction timeline.

- Price the exact lot and option set—then add a 10–15% buffer for surprises.

Timeline delays & rate-lock risks

The average single-family build takes 9–10 months, and weather, permits, or supply hiccups can stretch that further. Most mortgage rate locks last 30–60 days; if closing slips, you’ll need an extension or a new lock. Typical extension fees run ~0.25% of the loan per 30 days. On a $600,000 mortgage, that’s about $1,500 for one month.

Smart moves

- Consider a 180-day new-construction lock with a float-down if offered; the up-front fee often beats multiple extensions.

- Build in a 60-day buffer before locking.

- Track your lock expiration on the Loan Estimate and negotiate one free extension in your contract for builder-caused delays.

These steps can keep a construction delay from becoming a financial surprise.

“What’s not included” surprises

Model homes dazzle—but many features cost extra. A basic appliance package often omits the refrigerator (roughly $1,000–$2,000 for a mid-range stainless unit, plus $100–$280 delivery/installation). Whole-house blinds can add $200–$1,300, depending on style and window count. Even sod and starter landscaping may be add-ons; laying St. Augustine on a 5,000-sq-ft lot can run $5,000–$12,500.

Tip: Get the included-features sheet before you fall for model décor, and budget a separate line for move-in essentials.

HOA and CDD fees

Many master-planned communities bill two items:

- HOA dues (monthly/quarterly) for lawn care, gates, and clubhouse staffing. New single-family communities often run ~$300–$500/month.

- CDD assessments (on your tax bill) repay 20–30-year infrastructure bonds and cover maintenance. Typical totals equal ~$200–$300/month ($2,400–$3,600/year). The bond portion ends when paid off; the operations piece continues.

Action step: Request the HOA budget (what dues cover) and the CDD amortization schedule (years left on the bond) before signing.

Appraisal gaps

About one in nine sales sees an appraisal below contract. New construction is vulnerable because many design-center upgrades don’t boost comps. If a $650,000 build appraises at $620,000, the lender bases 80% financing on $620,000, not the contract. You’d bring ~$24,000 extra (20% of the $30,000 shortfall) or renegotiate.

Protect yourself

- Add an appraisal contingency or gap-coverage rider with a cash cap.

- Keep ~5% of the price liquid for potential gaps.

- Prioritize appraiser-friendly upgrades (e.g., an added bedroom) and save cosmetic splurges for post-closing.

Inspection isn’t optional

Budget $200–$500 for an independent inspector on a ~2,000-sq-ft home. Schedule two visits: pre-drywall to see framing straps, plumbing, ductwork, and what structural engineers look for during an inspection, and a final walkthrough to test outlets, fixtures, appliances, and verify attic insulation.