At the start of 2023, dealmakers were cautious about mergers and acquisitions due to the global economy troubled by fears of a recession and rising interest rates. Thus, deal volumes decreased by 4% from already low levels in the second half of 2022.

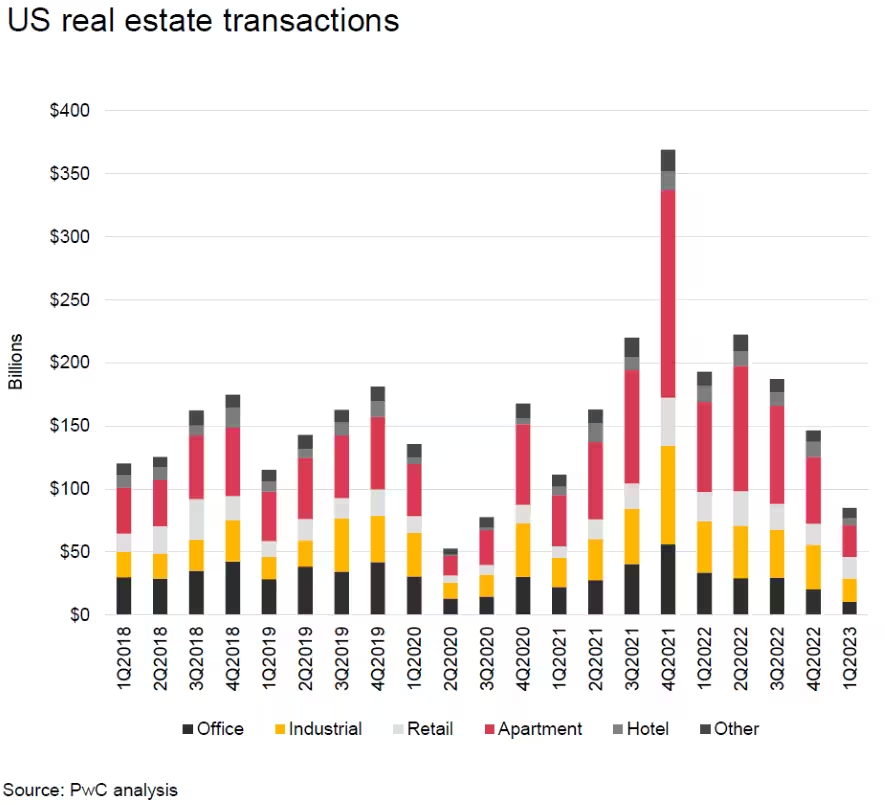

The real estate sector was also not immune to the economic downturn, as we can see from the statistics of deals made in the USA.

Despite the complex geopolitical and economic challenges in the world today, there are still optimistic forecasts for mergers and acquisitions over the next year. But before you initiate a deal, you should be aware of the real estate market health globally, whatever your reasons for mergers and acquisitions.

So, we are ready to assist in providing verified data on real estate trends across sectors and regions worldwide. Our data is sourced from PwC, a reputable global consulting firm. Therefore, you can rely on it without hesitation!

What are global M&A trends in real estate?

We have prepared the most important real estate M&A trends to provide you with deep insights into the current market dynamics and its competitive landscape. Moreover, knowing the latest trends allows you to develop win-win strategies and understand what to pay attention to during due diligence in mergers and acquisitions. We will explore the office, industrial, residential, retail, and hospitality sectors for this.

Office

- Vacancy rates for office properties remain high in all global regions due to macroeconomic events. The rising interest rates make the acquisition and construction debt more expensive, putting pressure on potential returns. In the near future, financing is expected to be more challenging.

- Successful mergers and acquisitions are expected to happen more frequently in areas with high demand, such as certain Asian cities, prime locations, and modern, high-quality buildings. Landlords remain hopeful that employees will return to working in an office, but the movement has been slower than expected in most places.

- New European regulations require buildings to meet specific energy efficiency standards, increasing demand for high-quality properties. Starting in 2023 in the Netherlands and 2030 in the UK, office buildings must have an energy performance certificate (EPC) rating of C or higher. To meet decarbonization goals, companies seek green technology-based office spaces that offer amenities to enhance the tenant experience.

Industrial

Trends vary by geography in the following ways:

Americas

- Mexico has become the leading trade partner with the US, overtaking China in the first quarter of 2023. As the demand for industrial assets in the US slows, Mexico is experiencing growth. The country is set to gain from the trend of onshoring or nearshoring as businesses relocate production operations to reduce supply chain disruption and geopolitical risks.

- South America is experiencing a thriving M&A scene driven by the growing demand for e-commerce. The agribusiness sector has significant potential for growth, with new development projects expected to double the current inventory in Chile. Additionally, there is a rising need for industrial parks – shared coworking spaces with access to utilities and roads – in Peru.

Europe

- The M&A deals in the European industrial sector remain dynamic. In particular, it’s driven by healthy rent growth and interest in newly built energy-neutral properties. At the same time, some European markets are facing challenges such as land shortages, rising construction costs and stricter environmental regulations.

Middle East and Asia–Pacific

- The Middle East and Asia-Pacific regions benefit from the e-commerce boom, leading to high occupancy and rental growth. Thus, Asia is expected to continue leading in the creation of new industrial developments, even though some manufacturers are expanding to other parts of the world (Mexico, for example). Despite normalizing supply chains and tenants managing future supply chain volatility, demand will still be higher than supply. So, any vacant spaces are expected to be filled quickly.

You may also want to know: Explore a comprehensive post-integration guide following https://mnacommunity.com/insights/post-merger-integration-guide/, which includes valuable insights for mergers and acquisitions consultants, CEOs, and all responsible decision-makers.

Residential

Trends vary by geography in the following ways:

The US

- Investors can find stability in the residential sector, even during uncertain economic times. However, there is a high concentration of new supply in expensive rental markets, mainly in class-A properties. Unfortunately, there is still a shortage of affordable and attainable housing options.

Europe

- Regulatory proposals to limit rent increases and improve fire safety standards in residential buildings make the environment more favourable for tenants. It may result in a decrease in real estate deals.

Mexico and the Middle East

- An increasing number of people working as digital nomads has increased rental demand in those areas. The Middle East’s housing market benefits from a more welcoming regulatory environment towards foreign investment, attracting investment from abroad.

Australia

- Investors show interest in manufactured housing estates and build-to-rent properties. Residents are becoming more favourable towards manufactured housing estates because they offer significant financial advantages such as lower exit fees and no capital gains sharing. In contrast, deferred management fee (DMF) retirement villages are less prevalent among residents.

Retail

- Retail sales are recovering more slowly in South America due to COVID-19 and macroeconomic uncertainty, while North America, Asia-Pacific, and EMEA regions are expected to continue with their strong performance.

- Retail rent growth has been strong due to consumers returning to in-store shopping and prioritizing spending on services over goods. As a result, there is a record-low availability of retail space.

- Shopping centers have changed in response to the way consumers shop. They have become mixed-use and offer experiential properties, which is expected to continue to drive mergers and acquisitions. In turn, tenants and landlords work together to improve their margins by repositioning these properties for mutual benefit.

Hospitality

- Despite economic uncertainty, mergers and acquisitions in the hospitality industry are expected to remain high. This is due to increased demand for domestic and international leisure travel. Both individual and group business travel is rebounding and is expected to contribute significantly to future M&A activity. As travel demand increases, hotel occupancy rates also go up, but there are challenges due to rising operating costs caused by inflation.

- Deal activity in the UK may be limited due to stricter fire safety regulations. These rules require additional spending to ensure compliance and may impact potential deals.

Final thoughts

Your efforts and deal success may vary depending on the real estate sector and geography. However, the more you know about the intricacies of M&A in your branch and country, the higher your chances of a positive outcome. Therefore, we recommend studying as many trends, strategies, forecasts, and statistics as possible to ensure a solid foundation before you take off.