Do you think it’s time to buy your property? So here are some ideas that Sky Marketing have listed here for you to make that dream come true.

Leave the rent problem behind and close the year and buy your property. If these are your plans, the first thing to do is organize your finances. With this attitude, you can organize – or get out of – debt and start building assets, acquiring the satisfaction of living in what is yours, in addition to all the stability that this achievement represents.

Want to know how to get out of the red and into your new apartment? Keep reading!

1. Count the Total of your Debts

See what financial issues you have and what amount is needed to pay off overdue commitments.

It is essential, from then on, to seek to negotiate these debts: try to contact creditors and signal to them your intention to make payments.

2. Prepare a Budget

Only after knowing exactly your earnings and expenses will you be able to see the portion of your income that you can use to pay off debts.

Therefore, prepare a neat budget, writing down each of your monthly expenses. Here, the most important thing is not to leave anything out of the budget, so include every penny that comes in and record what will be spent.

3. Organize your Expenses

Do you know the method I earn, spend and then see how it goes? Well, forget about it at once. From the decision to settle debts and buy a property, you will have to organize yourself.

With your budget in hand, make a list of consumption priorities — those items you can’t do without. Also, see everything that can be reduced or removed from the expense list. And follow the next tip!

4. Cut Unnecessary Expenses

Ready to make adjustments, be better able to pay your debts and achieve your goal of buying an apartment? Doing this requires reviewing consumption patterns and even lifestyles with a view to saving.

The good news is that the economy only depends on your consumption decisions. Then:

Take the superfluous items off the grocery list;

Don’t buy anything without first being sure you really need to make such an expense;

Make smart substitutions from a financial point of view — like swapping the street-bought snack for a homemade one, the TV subscription for DVDs or internet content, the expensive cell phone plan for a simpler one and other exchanges that value your money

In addition to these precautions, many others can be taken in order to adopt healthy consumption habits. Among them is the conscious use of credit, an efficient weapon to avoid indebtedness.

5. Invest your Money Well

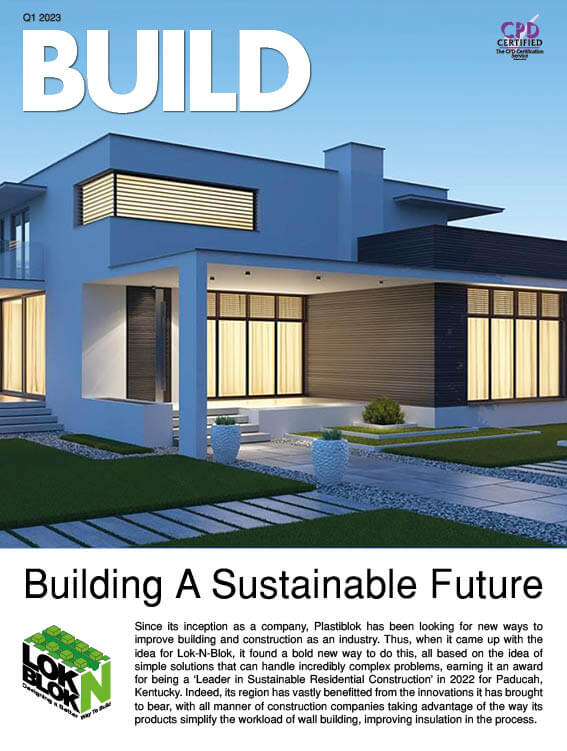

You changed the way you consume, managed to pay what was in arrears and reached a positive result. It is time, then, to direct your resources to the safest of investments: the purchase of a property (in Blue World City, for instance).

You have seen, so far, that with clarity and objectivity, it is possible to leave debts in the past and buy a property. In addition to following these tips, it is necessary to set a goal to guide each action in order to keep yourself as stimulated as possible. After all, there is nothing to stop a determined person from achieving their goal!

Also Read : Lahore Smart City Payment Plan 2022 | Location | Map | Plot for Sale