Commercial real estate (CRE) investing? Man, it offers some serious potential for building wealth and getting that sweet, sweet passive income, especially so in cities like Los Angeles. Thinking about owning a multi-unit apartment building that’s always full, a busy retail center where people are shopping, or an office complex buzzing with activity can really fire you up. But let me tell you, the stakes are way higher than buying a house, and just jumping in without a clear idea of what you’re doing is basically asking for trouble. Doing effective commercial real estate analysis isn’t just a nice suggestion; it’s your absolute must-have blueprint for navigating this complicated market, avoiding major risks, and actually finding those truly profitable opportunities. It’s the difference between making a smart move and making a mistake that costs you big time.

In my experience, the investors who consistently do well in CRE are the ones who are disciplined and systematic about looking at every single deal that lands on their desk. They don’t just go with their gut feeling or get swayed by fancy marketing brochures. They really dig deep into the numbers, the market dynamics, and the property itself. In this article, I’m going to share the framework I use for commercial property analysis – the one that’s worked for me. I’ll walk you through the practical steps and key things I think about when I’m dissecting a potential investment. My goal is to give you the tools and insights you need to look at your next CRE opportunity with confidence and a clear path toward potential success.

The Absolute Must-Do First Step: Why Good Analysis Saves You a Fortune

Investing in commercial real estate is a high-stakes game, no two ways about it. Unlike buying a simple single-family home, you’re usually dealing with much larger amounts of money, complex lease agreements, and market conditions that can change significantly. That’s exactly why skipping or rushing through a thorough property analysis isn’t just a little bit risky; it’s downright reckless. Analysis isn’t an extra thing you do if you have time; it’s the fundamental discipline that protects your hard-earned money and sets you up to succeed. It’s how you systematically peel back the layers of CRE investment risk – everything from changes in the market and whether your tenants are reliable, to the hidden physical condition of the property and the tricky details of how the financing is set up. By truly understanding these risks upfront, you can make smart decisions about whether an investment is even worth considering and, if it is, how to structure the deal to protect yourself (as highlighted by folks like thecaublegroup.com).

I figured out pretty early on that cutting corners here is just asking for a costly lesson. I remember seeing a colleague really excited about a retail property that seemed to offer great returns, totally captivated by the initial numbers the seller showed them. They didn’t really do enough analysis on the tenant’s business health or the specifics of their lease terms. Within a year, the main tenant went bankrupt, leaving the property with way more empty space than expected and the owner struggling to make the mortgage payments. If they had done a deeper dive during due diligence, they would have seen warning signs about that tenant’s financial stability. That experience really cemented my belief that rigorous analysis is the most powerful tool you have to avoid making those kind of devastating mistakes in CRE.

The Core Numbers I Actually Use (Beyond Just Cap Rate)

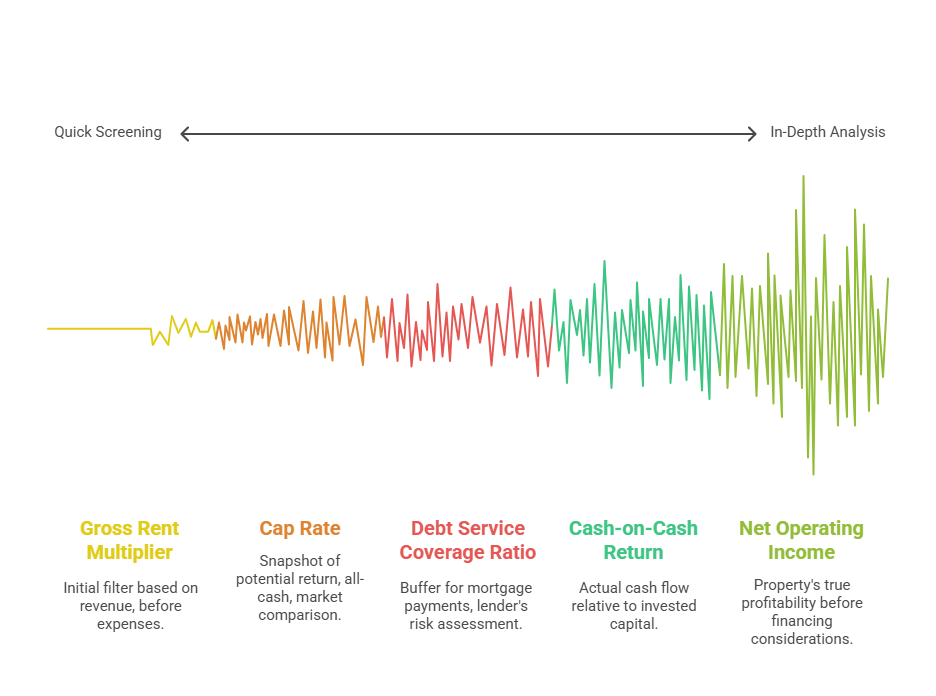

Moving past why analysis is so crucial, let’s talk about the actual language of commercial real estate: the financial metrics. These are the numbers that paint the picture of how a property might perform. While a lot of people only focus on the capitalization rate (Cap Rate), doing a complete CRE financial analysis means understanding several key calculations that work together. For me, these metrics are the absolute foundation for evaluating any potential investment.

Net Operating Income (NOI): What the Property Really Makes

I always start by figuring out the Net Operating Income (NOI) because it shows a property’s true profitability before you even think about financing. You calculate NOI by taking all the property’s income (rent, money from laundry machines, parking fees, etc.) and subtracting its operating expenses (property taxes, insurance, management fees, maintenance, utilities the owner pays). It’s really important to remember that NOI doesn’t include mortgage payments (principal and interest), major costs for things like a new roof or HVAC system (capital expenditures), or income taxes. This number gives you a clear view of the income generated purely from the property itself just operating.

Cap Rate: A Quick Snapshot (and Why It’s Not Enough)

The Cap Rate is probably the number you hear most often in commercial real estate. You figure it out by dividing the property’s NOI by its current market value or the price you’re paying (Cap Rate = NOI / Property Value). It’s a quick way to see the return you’d get if you paid all cash, and it’s often used to compare how similar properties in the same market stack up value-wise. A higher Cap Rate usually means a potentially higher return, but also maybe more risk, compared to properties with lower Cap Rates in the same area. Lots of new investors stop here, using Cap Rate as the only thing they look at, but I know that’s a mistake because it has some serious blind spots. It doesn’t take into account how debt will affect things, if the income might grow in the future, or if you’ll need to shell out a lot for major repairs – all of which are absolutely critical to what you actually make on your investment.

Cash-on-Cash Return: What You Actually Get Back Annually

This is one of the metrics I rely on heavily to understand the actual cash flow that comes back into my pocket each year. Cash-on-Cash Return shows you the annual before-tax cash flow the property generates compared to the actual cash you put into the deal (this is often discussed on sites like biggerpockets.com). You calculate it like this: (Annual Pre-Tax Cash Flow / Total Cash Invested). Your annual pre-tax cash flow is your NOI minus your annual mortgage payments (principal and interest). The total cash invested includes your down payment, closing costs, and any money you had to spend right away on repairs or renovations (check out sites like lev.co for info on financing). Unlike Cap Rate, Cash-on-Cash Return factors in how you financed the deal, giving you a much clearer picture of the actual money you see and the immediate return tied to the equity you’ve put in (as explained by resources like tacticares.com).

Debt Service Coverage Ratio (DSCR): Lenders Love It, and So Do I

Lenders always demand this number, but I pay close attention to DSCR myself because it tells me how much buffer I have to make my mortgage payments. The Debt Service Coverage Ratio is calculated by dividing the property’s NOI by its annual debt service (principal and interest payments) (DSCR = NOI / Annual Debt Service). Lenders usually want to see a DSCR of 1.20 or higher for commercial properties, meaning the property’s NOI is at least 20% more than what’s needed for the debt payments. A higher DSCR indicates the property is in a stronger position to cover the debt, signaling less risk from a financing standpoint (as noted by smartland.com).

Gross Rent Multiplier (GRM): A Quick Way to Screen (But Be Careful)

The Gross Rent Multiplier (GRM) is a really simple number calculated by dividing the property’s price by its total annual income (before any expenses) (GRM = Property Price / Gross Annual Income). It’s a super quick way to compare properties based on how much revenue they bring in relative to their price. I might use GRM for a quick filter on properties in a specific market to see if they’re even in the right ballpark, but I would never make a decision based on this alone. Because it doesn’t account for operating expenses or financing, it’s just a very rough estimate and should only be used for that initial quick look, not for any detailed analysis (alphamap.com can explain more about its limitations).

My Framework: Putting It All Together to Make a Decision

Analyzing a commercial real estate property means gathering a ton of information – the financial statements and projections, the inspection reports, title and survey documents, market research, and quotes for financing. The real skill, in my opinion, is in taking all that information and putting it together into one clear picture that allows you to make a confident investment decision. After I’ve gathered and analyzed everything using the steps I’ve outlined, I step back and look at the deal from a few different angles: how it performs financially, what the risks are, and if it fits with my overall investment strategy.

This isn’t just about hitting a certain Cash-on-Cash return or Cap Rate target; it’s about weighing the potential good stuff against the risks I’ve identified and understanding the property’s true potential under my ownership and management. Does the market analysis actually support the projected growth in rent? Did the due diligence uncover any major red flags that significantly change the risk or mean I’ll need unexpected money for repairs? Does the financing actually make sense for this specific deal’s cash flow? I evaluate if the projected returns are enough to make up for the risks I found. For example, I recently looked at a property with a Cap Rate that seemed attractive at first glance, but the due diligence showed there were significant maintenance issues that had been put off, and a bunch of leases were ending within the next 18 months. This meant the investment was exposed to a high risk of empty units in a market that was starting to slow down. Even though the initial numbers looked good, putting together the due diligence findings and the market analysis led me to conclude that the risks were just too high compared to the potential returns, so I passed on the deal. This multi-layered approach is how I go from raw data to making a final decision – go or no-go.

Common Mistakes I’ve Learned to Avoid (So Hopefully You Won’t Make Them)

In the world of commercial real estate investing, learning from mistakes is part of the journey. But by understanding common pitfalls, you can avoid some of the ones that cost you the most. Over my career, I’ve seen (and sometimes made myself, early on) certain mistakes that keep happening during the analysis phase and can totally derail an investment before you even buy it. Knowing what these are can save you a huge amount of time, money, and stress.

One of the biggest mistakes I see (and one I learned from the hard way early on) is underestimating how much operating expenses will actually be. Sellers naturally want their property to look as good as possible, and sometimes the expenses they report don’t show the real cost of running the property or they leave out necessary things. Just relying on the seller’s old or incomplete financials without checking them yourself and creating a realistic budget is a recipe for losing money every month. I always emphasize the importance of digging deep into every single expense category and getting quotes from third parties when you need to.

Another frequent pitfall is ignoring or not setting aside enough money for capital expenditures (CapEx). It’s easy to focus on the cash flow you’ll get right away, but not putting aside reserves for those big future repairs or replacements is shortsighted. A new roof, updated heating and cooling systems, or major structural repairs can easily cost tens or even hundreds of thousands of dollars. If you haven’t planned for these, they become unexpected emergencies that eat into your returns or force you to take out expensive loans.

Finally, falling in love with a property because it looks nice or you think it has great potential, instead of looking at the cold, hard numbers, is a dangerous trap. Emotional investing has no place in commercial real estate. Every decision should be based on objective analysis, realistic projections, and whether the deal meets the investment criteria and risk level you’ve set for yourself. Paying too much for a property just because you “really like” it, without the numbers to back up the price, is a sure way to get lower returns or even lose money (blog.thebrokerlist.com often discusses investment mistakes). Other costly errors include skipping crucial steps like a full inspection or an environmental review (psglending.com highlights due diligence mistakes).

Conclusion: Master Analysis, Master CRE Investing

As we’ve talked about, doing thorough and systematic analysis isn’t just a suggestion; it’s the absolute foundation of being successful in commercial real estate investing. From understanding key financial numbers like NOI and Cash-on-Cash return to doing a really deep dive with due diligence on the property’s physical condition, legal status, and environmental standing, every step is designed to uncover potential risks and confirm the investment’s true potential. Bringing in a strong understanding of the local market and how financing affects things makes that picture even clearer. Applying this systematic analysis framework is how I consistently approach the market, reducing risk and finding opportunities with confidence. By adopting this disciplined approach and avoiding common mistakes, you give yourself the power to make informed decisions and build a successful CRE portfolio. Start by creating your own checklist, adjusting these principles to fit your specific investment goals.