By Tom Brown, Managing Director at Ingenious Real Estate

Housing needs in the UK are changing amid declining levels of home ownership and lifestyle shifts. Rather than the traditional ‘buy-and-hold’ model, residential housing needs are shifting towards developments that are built for rent and aimed towards a specific demographic who are at a particular life stage. As such, funding needs are changing to support these types of developments and this should lead investors to consider new ways of accessing the property market.

For many years, the typical approach to property investing has been through longer-term investments in buy-to-let and equity. While this ‘bricks and mortar’ approach has worked well for many investors, a fully-valued market in both the residential and commercial sectors means that capital appreciation opportunities are now looking limited. Instead, investors should be looking to work their property assets operationally through shorter-term loan opportunities, which are used to fund the development or redevelopment of buildings in niche areas of the market. By viewing property investments as operational assets, investors can access a growing market opportunity that offers the potential for greater long term reward.

Why is the UK property market experiencing change?

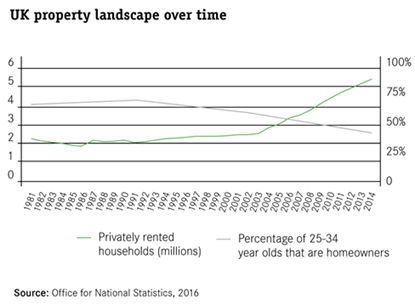

Homeownership levels have fallen dramatically among the younger generation over the last thirty years. In 1991, 67% of 25-34 year olds were homeowners compared with 36% in 2014. Meanwhile, private sector renting more than doubled between 1980 and 2014.[1] This is not just a UK phenomenon. In the United States, for example, home ownership fell to its lowest level in more than five decades in 2016.[2]

Declining homeownership is resulting from both cyclical economic forces as well as longer-term structural trends. In the post-financial crisis years since 2008, tighter lending standards have reduced the availability of mortgage financing for first time buyers, as low interest rates and constrained housing supply helped to sustain high house price valuations, thereby acting as a further deterrent. Whereas previous generations in the 1980s and 1990s benefited from schemes such as the right-to-buy, future generations have been left to deal with the consequences of reduced social housing stock. Supply is simply not keeping up with demand, and this has led to an estimated shortfall of almost 100,000 properties per annum.[3]

While economic pressures have been important contributors towards declining homeownership, especially among millennials, longer-term lifestyle shifts are also having a significant impact. The way people live and work is frequently less structured and standardised than in the past, and there appears to be less desire for people to be held down by long-term commitments. Coinciding with the advent of the ‘gig’ economy has been rising numbers of self-employed and contract workers over the last twenty years, suggesting a more mobile and flexible workforce.

There are already signs that changing lifestyle habits are impacting the commercial property sector. The Property Industry Alliance noted the rapid growth in serviced office and shared workspace providers in 2017, highlighting the growing demand for flexible property provision.[4] More generally, commercial property lease lengths have shortened significantly. The average lease length currently stands at around 7.5 years, having been as high as 25 years in the 1980s.

Many new leases include break clauses, another sign of tenants’ need for increased flexibility.[5] The retail sector has been hit the hardest, given declining footfall in town centres and the shift to online retailing. Indeed, the Q2 RICS Survey[6] showed falling occupier demand in retail, a higher vacancy rate, flat to falling rental growth, and negative capital value expectations over the next twelve months. One-third of respondents reported seeing an increase in the usage of Company Voluntary Arrangements (CVAs) over the past year.

Nonetheless, while both the residential and commercial property sectors are experiencing significant change, new investment opportunities are opening as developers adjust their product offerings to meet evolving economic conditions and lifestyles. In fact, some of the most innovative developments are happening in the residential market.

Co-living benefits the individual and the community

‘Co-living’ is an area of particular interest and future growth. These developments, which at this point are mainly focused in London, cater for young professionals’ more mobile lifestyles. They offer the convenience of all-inclusive costs, covering rent and bills as well as services such as cleaning and gym membership. This market is further developed in the United States and the evidence suggests widespread popularity in metropolitan areas such as New York and Oakland, California.

In addition to convenience, this type of living arrangement combines the benefits of feeling part of a community while at the same time offering individual privacy. Occupiers have shared living spaces, but they can also retreat to their own fully furnished private apartment. It presents an attractive choice for young people, especially as a national survey recently found that 16-34 year olds experience feeling more lonely than older generations.[7] Moreover, co-living developments could be targeted to people in later life who are downsizing though not yet in care and who would welcome the dual aspects of community participation

and privacy.

However, it is not just the investment potential that these types of new developments hold for investors. Co-living and other purpose-built rental developments may also hold wider economic benefits that could help the struggling UK high street. In effect, co-living provides instant communities and these, in turn, are likely to stimulate demand for service-type businesses like bars and restaurants since occupiers typically want to be close to amenities. Several local authorities are implementing initiatives to try to revitalise town centres primarily based around the idea of creating ‘community hubs’ through modernised libraries, leisure facilities and community events. Through its focus on community, co-living sits well with this approach to town centre regeneration and may help to attract much needed investment, leading to potentially greater demand for existing vacant office and retail units.

How can investors take advantage?

Investors can access these types of purpose-built rental developments through development finance or bridge loans, which are secured by the underlying assets and offer higher yields relative to UK government and corporate bonds – typically between 5% and 8% per annum net of fees. With banks and building societies retrenching from lending in the post-financial crisis years, this market presents a growing opportunity as developers look to secure funding from a diverse range of sources.

Although still at an early stage of development, operational assets are a logical, modern way to benefit from an evolving and changing UK property market.

The value of an investment may go down as well as up and investors may not get back the full amount invested. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. Past performance is not a reliable indicator of future results.

This communication is issued by Ingenious Capital Management Limited (“ICML”) which is authorised and regulated by the Financial Conduct Authority under Firm’s Reference Number 562563. Ingenious Real Estate is a trading name of ICML.

[1] Office of National Statistics, 2016

[2] Business Insider, Millennials are paying thousands of dollars a month for maid service and instant friends in modern ‘hacker houses’ , 2017

[3] Property Reporter, Is the UK’s housing crisis more than a supply and demand issue? 2018

[4] RICS Survey, Quarter 2, 2018

[5] Property Industry Alliance, Property Data Report 2017

[6] RICS Survey, Quarter 2, 2018

[7] Department for Digital, Culture, Media & Sport, Community Life Survey 2016-2017